2020 Property Tax Assessments and Financial Supports

Tax bills for approximately 530,000 residential and non-residential properties were mailed out to residents in the last week of May. All property owners should have received their property tax bill in the mail by now. Uou can access a breakdown here.

Property owners who have not received their property tax bill by the first week of June should visit calgary.ca/propertytax or contact 311 to obtain a copy of their bill.

Property tax is due Tuesday, June 30th. If you are facing financial hardship because of COVID-19, you have the option to delay your payment until Sept. 30 without a late payment penalty.

If you are able to pay the property tax on or before June 30, you can also participate in the Tax Instalment Payment Plan (TIPP), we recommend considering this option as property taxes will be supporting essential services for all Calgarians.

The property tax deadline does not apply to property owners who pay monthly through TIPP. The regular filing fee for taxpayers who join TIPP has been suspended until January 1, 2021. This makes it easier for property owners to join TIPP, which helps them avoid late payment penalties and a large lump payment. More than 270,000 property owners pay their tax monthly through TIPP. Property owners can join TIPP at any time by visiting the TIPP website to request an agreement or by calling 311.

The Tax Installment Payment Plan (TIPP) has suspended its 2% filing fee for taxpayers who join TIPP after January 1, which has been suspended until January 1, 2021.

The Property Tax Assistance program (PTAP) is available to assist eligible low-income homeowners who meet income guidelines and eligibility criteria, regardless of age.

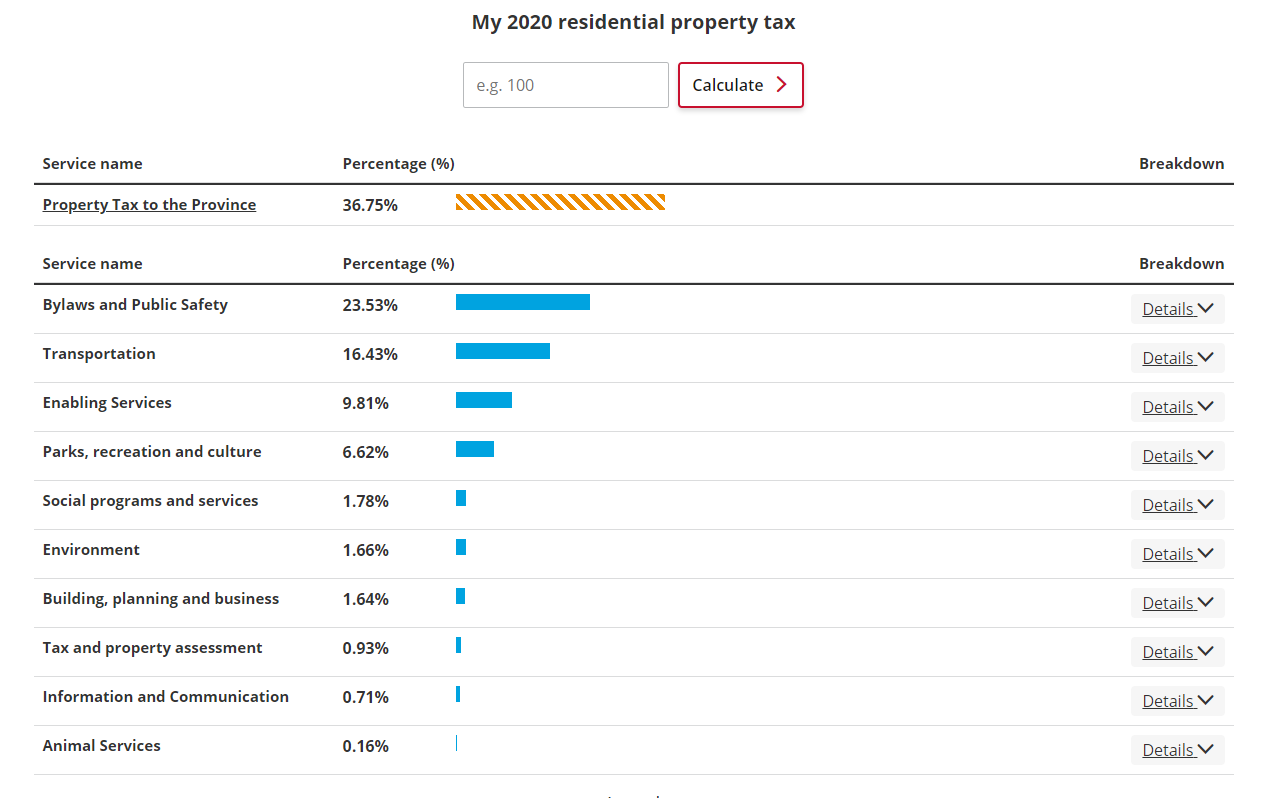

Funds collected through property tax are split between the Alberta Government and The City of Calgary. Property owners can visit the Property Tax Breakdown to enter the amount of their property tax and see how their municipal property tax dollars are invested in City services that Calgarians rely on every day. You will also be able to utilize the Property Tax Calculator tool for further information and estimates.

The City is committed to engaging with Calgarians and working together to ensure our services align with their priorities in a fiscally responsible manner. We want citizens to know how property tax is collected and used to deliver essential City services and programs while keeping the cost of local government low.

Council Approved New Relief Measures to Support Citizens and Businesses

The new relief measures introduced on April 6 are in addition to measures previously approved by Council:

Nov. 19, 2019 - Use of one-time funding to maintain last year’s municipal tax rate for both residential and non-residential property owners.

Nov. 19, 2019 - Shifting the tax responsibility from 49 per cent residential and 51 per cent non-residential, to 52 per cent residential and 48 per cent non-residential in order to provide support to businesses and non-residential property owners.

In November 2019, Council approved 2020 budget adjustments in a thoughtful process that allowed the Calgary Police Service and Civic Partners to preserve their budgets, while taking a least harm approach in reducing some City services. Additionally, Council directed Administration to provide options for a transitional non-residential phased tax program for 2020 and 2021, as well as strategies and initiatives to achieve targeted budget reductions of $24 million in 2021 and $50 million in support of Calgary’s economic recovery.

Feb. 3. 2020 - City Council approved $30 million in tax relief for Calgary businesses who have experienced the most significant municipal property tax increases over the past four years. Learn more about the 2020 Municipal Non-Res Phased Tax Program.

Mar. 16, 2020 – Utility payment relief measures established including increased payment flexibility installment plans, extending payment dates and/or suspension of collection-related activities on their ENMAX and City of Calgary municipal services. Additionally, disconnection of electricity service for non-payment has been suspended until further notice

Mar. 29,2020 – Business Improvement Areas late payments deferred from April 1 until June 30. For more information please visit: www.calgary.ca/covid-business

In addition to municipal taxes, municipalities collect taxes on behalf of the province. The combination of the municipal and provincial increases results in a combined increase to residential taxpayers of:

7.55 per cent or $240 per year ($20 per month) for the median assessed property of $455,000 after the Council rebate.

Excluding the impact of assessment changes and Phased Tax Program (PTP) rebates, non-residential taxpayers will see a combined decrease of:

12.07 per cent or $2,640 per $1 million of assessed value annually ($220 per month) after the Council rebate

Tax Instalment Payment Plan (TIPP)

The Tax Instalment Payment Plan (TIPP) is a popular program that allows you to pay your property tax on a monthly basis instead of one payment in June.

Property Tax Assistance Program (PTAP)

If you are a residential property owner experiencing financial hardship, regardless of age, you may be eligible for a credit/grant of the increase on your property tax account.

Alberta Seniors Property Tax Deferral Program

The Alberta government also offers a Seniors Property Tax Deferral Program. This program allows eligible senior homeowners to voluntarily defer all or part of their residential property tax, including the education tax portion. This is done through a low-interest home equity loan with the Government of Alberta.

Utility Bill Support Programs

In response to the COVID-19 situation, we have implemented a COVID-19 customer relief program for residential and small commercial ENMAX customers. This includes increased payment flexibility such as installment plans, extended payment dates and suspension of collection-related activities on your account. We will not disconnect services, and late payment fees will not apply until further notice.

In addition, the Government of Alberta and City of Calgary announced 90-day payment deferral programs.

You have the option of either deferring your bills entirely through the Government of Alberta and City of Calgary programs, or setting up a customized payment plan to best manage your bills at this time.

Please call us at 310-2010 to discuss the options available through our COVID-19 customer relief program or to set up a 90-day payment deferral.

If you are a commercial customer and have questions about your account, please contact your dedicated Account Manager or Client Care at 1-866-331-2199 or business@enmax.com.